Hey there! Have you ever wondered if the scholarships you receive are taxable? Well, guess what? We’re here to give you all the details and clear up any confusion you may have. So, let’s dive in and find out if those scholarship dollars are going to be taxed or not.

In this article, we will explore the topic of whether scholarships are taxable or not. We’ll take a closer look at the different types of scholarships and the criteria that determine their taxable status. We’ll also discuss any exceptions or special circumstances that may apply. By the end of this article, you’ll have a better understanding of how scholarships can impact your taxes. So, if you want to make sure you’re on the right side of the law when it comes to reporting your scholarships, keep reading!

What are Scholarships?

Definition of scholarships

Scholarships are financial awards given to students to help them pay for their education. These awards are typically based on academic achievement, athletic ability, or other criteria set by the scholarship provider. Scholarships are considered a form of financial aid and can greatly reduce the cost of attending college or university.

Different types of scholarships

There are several different types of scholarships available to students. Some common types include:

-

Merit-based scholarships: These scholarships are awarded to students who have demonstrated exceptional academic or extracurricular achievements. They are typically based on high GPA, SAT/ACT scores, or other academic accomplishments.

-

Need-based scholarships: These scholarships are awarded to students with financial need. They take into account factors such as income, assets, and family size to determine eligibility.

-

Athletic scholarships: These scholarships are awarded to student-athletes who excel in sports. They are typically offered by colleges and universities to recruit talented athletes to their athletic programs.

-

Talent-based scholarships: These scholarships are awarded to students who possess a particular talent or skill, such as music, art, or writing.

-

Ethnic or cultural scholarships: These scholarships are awarded to students from specific ethnic or cultural backgrounds. They promote diversity and provide opportunities for underrepresented groups.

-

Employer-sponsored scholarships: These scholarships are offered by companies and organizations to their employees or their dependents as a benefit of employment.

Scholarships can be a valuable source of funding for students, as they do not need to be repaid like student loans. However, it is important to understand the tax implications of scholarships, as they may be subject to taxation.

Taxable vs Non-taxable Scholarships

Understanding taxable scholarships

Scholarships are generally considered tax-free if they meet certain criteria. According to the IRS, a scholarship is tax-free if it is used to pay for qualified education expenses. These expenses include tuition and fees required for enrollment, as well as books, supplies, and equipment necessary for coursework.

Determining if scholarships are taxable

To determine if a scholarship is taxable, you need to consider how the funds are used. If the scholarship funds are used to pay for qualified education expenses, they are not taxable. However, if the funds are used for other purposes, such as room and board, they may be subject to taxation.

Examples of non-taxable scholarships

Here are some examples of scholarships that are generally considered non-taxable:

-

Scholarships used to pay for tuition and fees: If your scholarship funds are used to pay for your tuition and fees, they are generally not taxable. These funds directly offset the cost of education and are considered qualified education expenses.

-

Scholarships used to pay for books and supplies: If your scholarship funds are used to purchase books, supplies, and equipment required for coursework, they are also generally not taxable. These expenses are considered necessary for your education and are therefore eligible for tax-free treatment.

-

Scholarships that require you to perform services: If you receive a scholarship that requires you to perform services, such as teaching or conducting research, the value of the scholarship may still be tax-free. However, any additional income you receive for performing these services may be subject to taxation.

It is important to note that scholarships used for non-qualified expenses, such as room and board, are generally taxable. These expenses are considered personal living expenses and are not eligible for tax-free treatment.

Taxable Scholarship Components

When determining the taxability of a scholarship, it is important to consider how the funds are allocated. Scholarships can be broken down into several components, each with its own tax implications. Here are some common components of scholarships:

Tuition and fees

Scholarship funds used to pay for tuition and fees are generally not taxable. These expenses directly offset the cost of education and are considered qualified education expenses. However, it is important to keep in mind that any scholarship funds used for non-qualified expenses, such as room and board, may be subject to taxation.

Books and supplies

Scholarship funds used to purchase books, supplies, and equipment required for coursework are generally not taxable. These expenses are considered necessary for your education and are therefore eligible for tax-free treatment. However, if the funds are used for non-qualified expenses, they may be subject to taxation.

Room and board

Scholarship funds used for room and board are generally taxable. These expenses are considered personal living expenses and are not eligible for tax-free treatment. It is important to keep detailed records of how your scholarship funds are allocated to ensure accurate reporting on your tax return.

Miscellaneous expenses

Scholarship funds used for miscellaneous expenses, such as transportation or personal expenses, may be taxable. These expenses are not considered qualified education expenses and therefore may not be eligible for tax-free treatment. It is recommended to consult a tax professional for guidance on the taxability of these expenses.

Tax Exemptions for Scholarships

While scholarships are generally considered taxable if used for non-qualified expenses, there are some exemptions and exclusions that may apply. Here are a few common exemptions and exclusions for scholarships:

Qualified tuition program

If you receive a scholarship from a qualified tuition program, such as a 529 plan, the funds may be tax-free. These programs are designed to help families save for future education expenses. The funds can be used for qualified education expenses, including tuition, fees, books, supplies, and equipment. It is important to keep in mind that any funds used for non-qualified expenses may be subject to taxation.

Employer-provided scholarships

Scholarships provided by your employer may be tax-free if they meet certain criteria. To qualify for tax-free treatment, the scholarships must be used for qualified education expenses. In addition, the scholarships must be for undergraduate education and cannot exceed certain limits set by the IRS.

Veteran education benefits

If you are a veteran receiving education benefits, such as the GI Bill, the funds may be tax-free. These benefits are intended to help veterans pursue higher education or training programs. The funds can be used for qualified education expenses, including tuition, fees, books, supplies, and equipment.

It is important to review the specific guidelines for each scholarship or benefit to determine its taxability. Consulting a tax professional can help ensure accurate reporting and maximize any available tax benefits.

Tax Reporting for Scholarships

When it comes to reporting scholarships on your tax return, there are several forms to be aware of. Here are some common forms used to report scholarships:

Form 1098-T

If you receive a scholarship from a college or university, you may receive a Form 1098-T. This form reports the amount of qualified education expenses paid and any scholarships or grants received. It is important to review the information on this form and ensure it is accurate. You may need to submit this form when preparing your tax return.

Form 1099-MISC

If you receive a scholarship from an organization or individual, you may receive a Form 1099-MISC. This form reports the amount of income received and is typically used for reporting self-employment income. It is important to report this income on your tax return even if you did not receive a 1099-MISC.

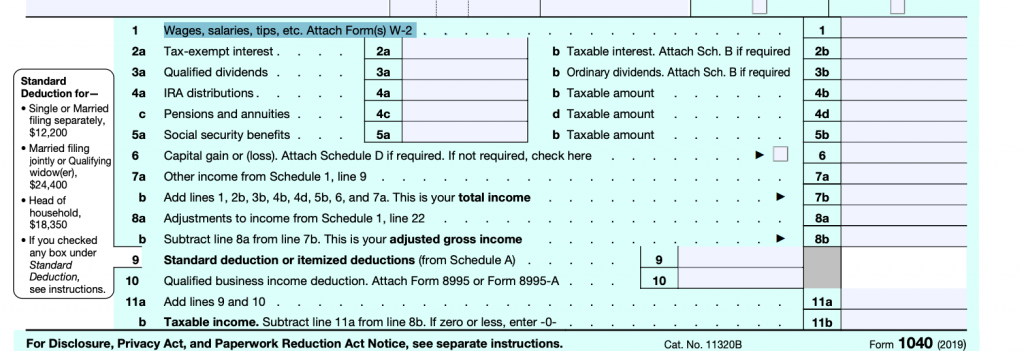

Reporting scholarships on tax return

When preparing your tax return, you will need to report any taxable scholarships as income. If you receive a Form 1099-MISC, you should report the income on the appropriate line of your tax return. If you did not receive a 1099-MISC, you should still report the income and provide a detailed explanation of where the funds came from.

Impact on Educational Expenses Deductions

Scholarships can have an impact on certain tax deductions related to educational expenses. Here are a few deductions that may be affected by scholarships:

Student loan interest deduction

If you have student loans, you may be eligible for a student loan interest deduction. This deduction allows you to deduct up to $2,500 of student loan interest paid during the year. However, if you receive tax-free scholarships, you cannot use that money to pay your student loan interest and still claim the deduction. It is important to keep detailed records of your scholarship funds and their use to determine your eligibility for this deduction.

Educational tax credits

There are several educational tax credits available, such as the American Opportunity Credit and the Lifetime Learning Credit. These credits can help offset the cost of education expenses. However, if you receive tax-free scholarships, you cannot use that money to pay for qualified education expenses and still claim the credits. It is important to review the specific requirements for each credit to determine your eligibility.

It is recommended to consult a tax professional for personalized guidance on how scholarships may impact your specific tax situation. They can help you navigate the complex rules and ensure you take full advantage of any available tax benefits.

Exceptions and Exclusions

While most scholarships are generally considered taxable or non-taxable based on their use, there are some exceptions and exclusions to be aware of. Here are a few examples:

Fellowship grants

Fellowship grants are similar to scholarships but are typically awarded to graduate or postgraduate students pursuing research or advanced study. These grants are generally considered taxable income, regardless of how the funds are used. It is important to report fellowship grants as income on your tax return.

Scholarships for non-degree programs

Scholarships used for non-degree programs, such as vocational or trade schools, may be subject to different tax rules. These programs are typically not eligible for the same tax benefits as traditional degree programs. It is important to review the specific guidelines for each scholarship or program to determine its taxability.

It is recommended to consult a tax professional for guidance on any exceptions or exclusions that may apply to your specific situation. They can help ensure accurate reporting and minimize any potential tax liability.

Tax Tips and Advice

When it comes to scholarships and taxes, there are several tips and advice to keep in mind. Here are a few:

Keeping detailed records

It is important to keep detailed records of your scholarship funds and their use. This will help determine the taxability of your scholarships and ensure accurate reporting on your tax return. Be sure to keep copies of any 1098-T or 1099-MISC forms you receive, as well as receipts for qualified education expenses.

Consulting a tax professional

While scholarships may seem straightforward, the tax implications can be complex. Consulting a tax professional can help ensure you understand the rules and regulations specific to your situation. They can provide personalized guidance and help you maximize any available tax benefits.

State and Local Taxes on Scholarships

In addition to federal taxes, scholarships may also be subject to state and local taxes. The taxability of scholarships at the state and local level varies depending on where you live. Some states follow the federal tax treatment, while others have their own rules and regulations.

State tax implications

Some states do not tax scholarships at all, regardless of how the funds are used. Other states only tax scholarships if they are used for non-qualified expenses, such as room and board. It is important to review the tax laws and regulations in your state to determine the taxability of your scholarships.

Local tax implications

In addition to state taxes, scholarships may also be subject to local taxes in certain jurisdictions. These taxes can vary greatly depending on where you live. It is important to review the local tax laws and regulations to determine the taxability of your scholarships.

It is recommended to consult a tax professional who is familiar with the tax laws and regulations in your state and local jurisdiction. They can help ensure accurate reporting and minimize any potential tax liability.

Conclusion

Understanding the taxability of scholarships is crucial for accurate tax filing. While scholarships used for qualified education expenses are generally tax-free, scholarships used for non-qualified expenses may be subject to taxation. It is important to review the specific guidelines for each scholarship or program to determine its taxability.

It is recommended to consult a tax professional for personalized guidance on how scholarships may impact your specific tax situation. They can provide accurate advice and help you navigate the complex rules and regulations.

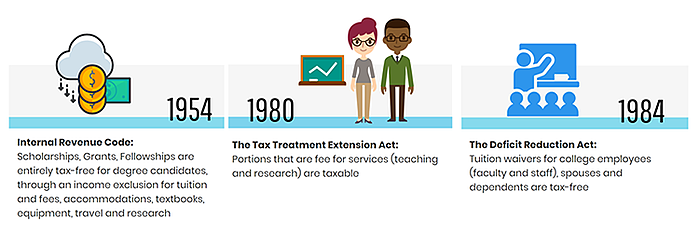

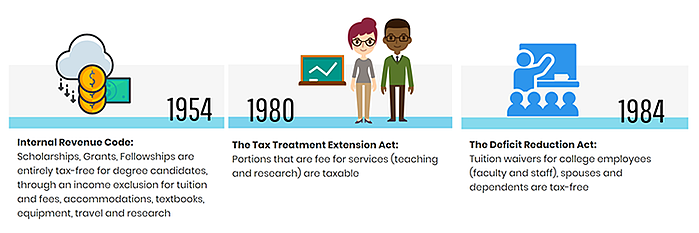

Stay informed about changes in tax laws and regulations. The taxability of scholarships may change over time, so it is important to stay up to date with any new developments. By staying informed and seeking professional guidance, you can ensure accurate reporting and maximize any available tax benefits.