What is Financial Aid? Financial aid is money that helps students pay for college. It can come from the federal government, state governments, colleges and universities, private organizations, and other sources. Financial aid can be in the form of grants, scholarships, loans, or work-study programs.

What is Financial Aid? Financial aid is money that helps students pay for college. It can come from the federal government, state governments, colleges and universities, private organizations, and other sources. Financial aid can be in the form of grants, scholarships, loans, or work-study programs.

For many students and their families, the cost of college is a major concern. Fortunately, there are a variety of financial aid options available to help make paying for college more manageable. In this article, we’ll provide an overview of financial aid, including what it is, where it comes from, how to apply for it, and the benefits it provides.

Before you begin applying for a financial aid package or a scholarship, there are several things that you need to be aware of. Whether you are a few years off from college or it is right around the corner, it is never too late to educate yourself on your options. If you aren’t sure which ones are right for you, you can go to your school’s guidance counselor for more information. Before applying for a traditional student loan, it is a good idea to make sure that you do not qualify for any free aid or scholarships.

Prior Financial Aid or College Savings

First, you will need to see how money your parents have put aside for your education. The larger the amount is, the harder it may be to qualify for a loan or extra aid. This is not to say that parents should not put money aside for their children’s future, but it will be accounted for during the application process. If they make a large amount of money, or they have a substantial amount in a college 529 plan, it may be next to impossible for you to get financial aid.

List of University or College Lenders

Before you approach a lender, it is a good idea to visit your school to get a list of lenders that they already work with. This lessens your chance of getting stuck with a less reputable lender and you’ll have the added benefit of knowing that other students are using these same lenders for financing their education. Each college should have this list prepared, and you can usually get it from the admissions office. If you are unsure about an institution and they are not on the list of preferred lenders, it is probably best to steer clear of them.

Now that you have the list of preferred lenders, you can begin applying for financial aid. You will be asked to complete an application and you will to supply some extra paperwork with it. For example, you will need to have a copy of your parent’s tax return, your own tax return as well as any employment history you may have. A recommendation letter is always nice to include and can increase your chances of approval.

Be completely honest on your application. If you are approved, you will be required to sign a promissory note. This is basically an agreement that holds you liable for repayment of the loan. Failure to do so can result in wage garnishment, or you can even be sued.

Top 3 Main Types of Financial Aid:

- Need-based aid

- Merit-based aid

- Student loans

Need-based aid is awarded based on the student’s financial need. Merit-based aid is awarded based on the student’s academic achievement or other factors such as community service or leadership activities. Student loans must be repaid with interest and are available to both undergraduate and graduate students.

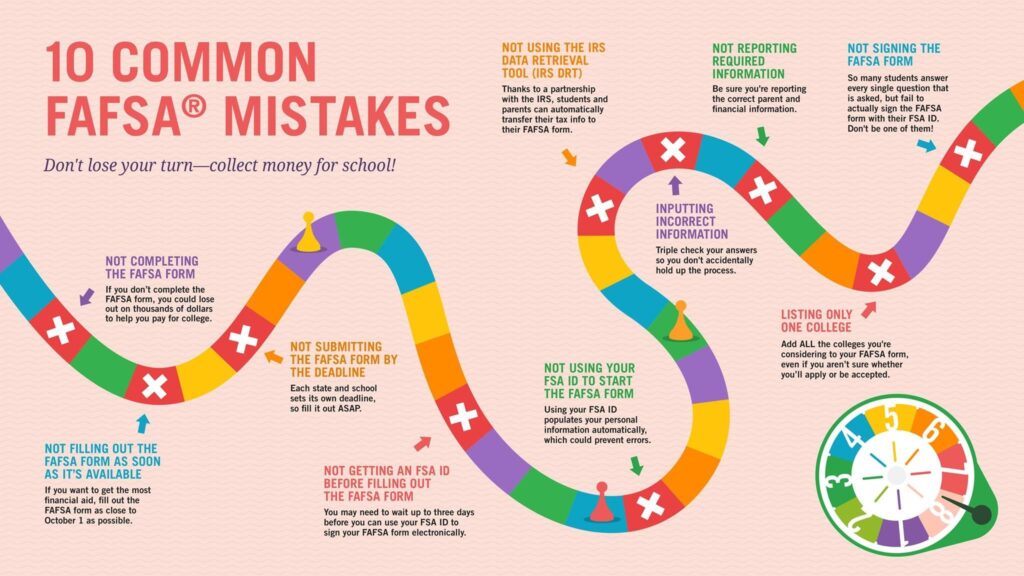

How to Apply for Financial Aid Through FAFSA

The first step in applying for financial aid is to fill out the Free Application for Federal Student Aid (FAFSA). The FAFSA is a form that collects information about the student’s finances, including income, assets, and expenses. The information from the FAFSA is used to determine the student’s eligibility for federal financial aid programs.

The FAFSA should be submitted as soon as possible after October 1st of each year. Some states and colleges have earlier deadlines, so it’s important to check with your school’s financial aid office for more information.

After the FAFSA has been submitted, the student will receive a Student Aid Report (SAR). The SAR contains information about the student’s eligibility for financial aid. The student should review the SAR carefully and make any necessary changes.

Once the SAR has been processed, the student will receive a financial aid award letter from each school they have applied to. The award letter will list the types and amount of financial aid the student has been approved for at that particular school.

The student should compare their award letters and choose the school that offers the best overall package of financial aid – meaning, the school that provides the most money in grants or scholarships rather than loans.

Benefits of Financial Aid

For many students and their families, financial aid makes attending college possible. According to a report from The College Board:

“On average, full-time students who received grant aid paid 59% of their total college costs from their own resources – earnings from summer work and savings – compared with 80% of those who did not receive grant aid.”

In other words, receiving financial aid can help reduce your out-of-pocket costs for college significantly.

In addition to reducing your costs while you’re in school, receiving financial aid can also help you graduate with less debt – or even no debt at all! According to The College Board report mentioned above “among bachelor’s degree recipients who borrowed before earning their degree (undergraduate Class of 2015), those who received Pell Grants graduated with 39% less debt than those who did not.” So if you’re considering taking out loans to help pay for college, remember that there are grants available that could help you reduce your overall borrowing amount. And as we all know – less debt is always better!

Below we have listed all of the main types of financial aid available to you from the Federal government and also through your state, along with other financial programs. FAFSA is listed again since it is an important step for Federal financial assistance:

List of Federal Student Aid Options

The main source of financial aid comes from the federal government. Here are the key programs and resources:

FAFSA

The Free Application for Federal Student Aid (FAFSA) is the essential application to apply for federal grants, loans, and work-study. Fill it out annually.

Federal Student Loans

The main federal loan programs are the Direct Subsidized and Unsubsidized Loans. Maximum amounts are $5,500-$12,500 per year depending on grade level and dependency status.

Federal Pell Grants

Federal Pell Grants provide up to $6,895 in free aid to low-income students. Amounts vary based on need and costs.

Other Federal Grants

Other grants like the FSEOG and TEACH Grant provide additional aid in certain situations.

List of State Financial Aid Options

Many states and colleges offer location-based aid programs:

State Grants

Research grants for your state. For example, the Cal Grant in California.

Institutional Aid

Look for grants and scholarships offered directly through your college’s financial aid office.

Loan and Grant Programs for Specific Situations

Some key aid programs exist for unique circumstances:

Military Aid

Military members and families have programs like the GI Bill and Military Tuition Assistance.

Graduate Student Loans

Graduate students have increased loan limits through the Grad PLUS and Grad Unsubsidized loans.

Parent PLUS Loans

Parents of dependent undergrads can apply for Parent PLUS loans.

Special Circumstances

Those with disabilities, vocational goals, or facing other challenges may qualify for things like Perkins loans or vocational rehabilitation aid.

If you’re looking for more information on financing your education beyond just grants and scholarships – like options for responsible student loans – check out our blog post on responsible borrowing!

Alternative Financing Options

Paying for college can be a significant financial burden, and while traditional financial aid options like scholarships, grants, and loans are commonly used, there are several alternative financing strategies that can ease the financial strain. Here’s an exploration of some overlooked strategies:

529 College Savings Plan

A 529 College Savings Plan allows families to grow their savings tax-free, provided the money is spent on qualified educational expenses. According to Sallie Mae’s “How America Pays For College 2021” study, parent income and savings covered about 45% of total college costs, and 37% of parents used a 529 plan to help pay for college. These plans can be a significant source of funding, yet around two-thirds of families are not utilizing these tax-advantaged accounts.

Local Scholarships

Local scholarships offered by community organizations, nonprofits, or places of worship may not provide large award amounts like national scholarships, but they are often less competitive. Some companies also offer scholarships to dependents of their employees. These local opportunities can chip away at the overall cost of college.

Financial Aid Appeals

If a family’s financial situation changes, such as job loss or salary reduction, they can request a financial aid appeal or professional judgment from a college. This process recognizes extenuating circumstances and changing economic conditions, allowing for potential adjustments to financial aid packages.

No-Loan Schools

Some institutions, like Amherst College or Stanford University, aim to meet each student’s full demonstrated need without loans. Financial aid comes in the form of scholarships, grants, and work-study, often limited to students from lower- or moderate-income households.

Employer Tuition Assistance

Many companies, including some fast-food chains, offer tuition assistance to help employees afford a college degree. This assistance may be capped at a certain amount but can be a valuable resource for working students.

Advanced Placement and Dual-Enrollment Credits

High scores on Advanced Placement (AP) exams or participation in dual-enrollment programs can earn college credit, potentially reducing tuition costs. Some schools award course credits based on AP scores, while dual enrollment allows high school students to earn credits at local community colleges.

Prior Learning Assessments

Prior learning assessments award credit for learning outside the traditional classroom, including through portfolio assessment, evaluation of non-college learning, and standardized exams like the College Level Examination Program (CLEP). These credits can lead to significant savings.

ROTC Programs

The Reserve Officers’ Training Corps (ROTC) offers scholarships that cover tuition, fees, and books, or room and board, in exchange for a commitment to work in the U.S. military after graduation.

Regional Tuition Exchange Programs

Regional tuition exchange programs, such as the Western Undergraduate Exchange or the Midwest Student Exchange Program, allow students to qualify for reduced tuition rates as out-of-state students. These programs can make public schools more affordable for out-of-state attendees.

Wrapping it all up!

Applying for financial aid can seem daunting at first – but it doesn’t have to be! Hopefully, this article has provided some useful information and resources for your financial aid search and how the right financial aid can better help you pay for college. These alternative financing options described above provide diverse pathways to make college more affordable. By exploring and/or combining these strategies, students and families can create a customized approach to funding education without relying solely on traditional loans or draining personal savings.